MO Investor – One App For All Investment Needs

August 20, 2020 Leave a comment

Feeling totally penned in by Covid -19 ? Frustrated that you’re not as productive as you’d normally like to be?Does it feel like a lost year when it comes to earning ?

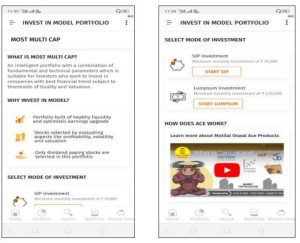

Here’s a solution : The Motilal Oswal’s Investor App.Start with EDUMO. Whether you are a beginner looking to learn the ABCs of investing or looking to refresh your knowledge or learn more advanced topics,there’s something good for you here.Also MO Investor helps you keep abreast of market news with live market updates and you can focus more on what interests you by using the customisable multi- asset watch list.

Frankly there is no investment better than an investment in yourself. And education is one of the best investments you can make in yourself. That too an education that can help you acquire skills and knowledge that you can directly apply to make money.

Been struck by how sections of the digital economy are thriving,even as more traditional businesses suffer due to Covid-19 disruptions ? Bothered that these company stocks are not listed on the Indian Exchanges ?MO Investor App allows you to invest in 3500 US stocks and ETFs seamlessly. You can simply open demat account with Motilal Oswal and get started. Read more of this post

You can’t run a shop without cash in the till. And in the same way you can’t get through life smoothly without a certain cushion of readily accessible cash that you can dip into as per your need. For quite a while now, readily accessible money meant various types of bank accounts, stocks and mutual funds that you could cash in fast whenever needed even as they continued to grow quietly in the background.

You can’t run a shop without cash in the till. And in the same way you can’t get through life smoothly without a certain cushion of readily accessible cash that you can dip into as per your need. For quite a while now, readily accessible money meant various types of bank accounts, stocks and mutual funds that you could cash in fast whenever needed even as they continued to grow quietly in the background. It is crucial to invest your retirement corpus diligently. Before you make your investment decisions, evaluating and analyzing different options is beneficial. You do not want to speculate your retirement corpus. You may prefer earning slightly lower returns for the security of your funds.

It is crucial to invest your retirement corpus diligently. Before you make your investment decisions, evaluating and analyzing different options is beneficial. You do not want to speculate your retirement corpus. You may prefer earning slightly lower returns for the security of your funds.