Life insurers like HDFC Life, Aviva India and Bajaj Allianz have started focussing heavily on the online platform for selling ULIPS (unit-linked insurance plan), promoting them as low-cost products, in the last few months.These policies are cheaper than their offline counterparts, as the savings made on agents’ commissions are passed on to policyholders in the form of lower premium allocation charges.

Life insurers like HDFC Life, Aviva India and Bajaj Allianz have started focussing heavily on the online platform for selling ULIPS (unit-linked insurance plan), promoting them as low-cost products, in the last few months.These policies are cheaper than their offline counterparts, as the savings made on agents’ commissions are passed on to policyholders in the form of lower premium allocation charges.

Insurers are launching these online Ulips to counter distributors’ reluctance to promote ULIPS . Over the last four years (post September 2010, when IRDA imposed a cap on ULIP charges), many agents and brokers have stopped selling ULIPS.

While the broad structure of a lowcost ULIP sold online is similar to a regular ULIP, slashing of premium allocation charges is the key differentiating feature. HDFC Life’s online ULIP has completely done away with allocation charges.It only charges fund management fee and a risk premium for mortality cover and on this aspect, directly competes with ELSS Mutual funds. The entire premium paid by the customer gets invested. Aviva’s product levies a premium allocation fee of 4-5%, compared to its offline counterpart that charges 8-9%. Bajaj Allianz’s online ULIP levies premium allocation charges ranging from 0-5.5% in the first five years, depending on the premium amount and year. Read more of this post

Life insurers like HDFC Life, Aviva India and Bajaj Allianz have started focussing heavily on the online platform for selling ULIPS (unit-linked insurance plan), promoting them as low-cost products, in the last few months.These policies are cheaper than their offline counterparts, as the savings made on agents’ commissions are passed on to policyholders in the form of lower premium allocation charges.

Life insurers like HDFC Life, Aviva India and Bajaj Allianz have started focussing heavily on the online platform for selling ULIPS (unit-linked insurance plan), promoting them as low-cost products, in the last few months.These policies are cheaper than their offline counterparts, as the savings made on agents’ commissions are passed on to policyholders in the form of lower premium allocation charges. If wealth building,wealth protection,estate planning,legacy planning,cash management etc. are not priorities,then an online term plan is probably the best life insurance product you can purchase.

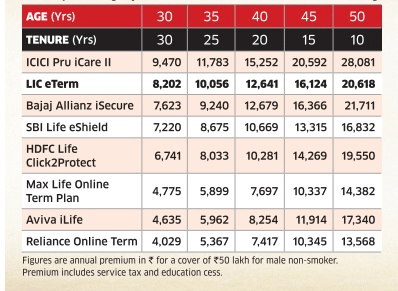

If wealth building,wealth protection,estate planning,legacy planning,cash management etc. are not priorities,then an online term plan is probably the best life insurance product you can purchase.