Tomorrow is Akshaya Tritiya,and the gold fever is spreading.A lot of people have seen pricey ads like the one to the left and asked me if its a good deal and whether they should go for it.Here is my answer:

Tomorrow is Akshaya Tritiya,and the gold fever is spreading.A lot of people have seen pricey ads like the one to the left and asked me if its a good deal and whether they should go for it.Here is my answer:

I know neither Shilpa Shetty nor Raj Kundra personally.Obviously they make money.But how steadily is something I don’t know.Nor exactly how much.I see their names associated with a lot of new businesses.They leverage their celebrity status.They have their money in start-ups but just what assets they have and where and how any personal guarantees can be enforced,is something I can’t tell you.And the Satyug Gold Purchase Plan is nothing more than an entrepreneur’s promise to pay.An unsecured promise to pay.And as such I will analyse the product.

All business people,as long as they have a reputation of being reasonably reliable and not thieves, have access to funds from other business people.The credit is unsecured and of short term duration and the interest is over 2% per month.Some negotiation might be possible but not all that much.

Various companies come up with fixed deposit schemes.They offer some financial statements of various levels of reliability for us to peruse.Currently company deposits give you round 13%pa.

In case of the Satyug Gold Purchase Plan,depending on the tenure you choose, you get a discount on the day’s gold price.And a year later you get delivery of the quantity of gold you purchased,irrespective of the then price.So first off, you bear the price risk which will determine your final returns.Then,assuming that the price of gold remains constant at the Rs 28,000 per 10 grams,you get returns ranging from:15% to 9%.And they are neither fixed nor predictable.

So,now its your call if you feel adequately compensated for the risk of total capital loss by these rates.My only advice is to go for the 1 year option if you must.At all costs avoid the multi-year options as even ordinary FDs are better risk adjusted options.

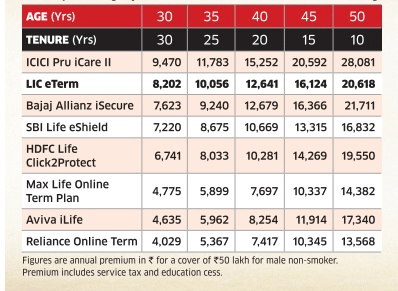

If wealth building,wealth protection,estate planning,legacy planning,cash management etc. are not priorities,then an online term plan is probably the best life insurance product you can purchase.

If wealth building,wealth protection,estate planning,legacy planning,cash management etc. are not priorities,then an online term plan is probably the best life insurance product you can purchase. Previously you had to visit banks,travel agents or other licensed forex dealers or hawala operators for your forex needs.Now not only banks and travel agents have gone online,but there are now online-only licensed forex sites,that deliver the foreign currency you buy to your hands.How cool is that?Following is a list of such sites.

Previously you had to visit banks,travel agents or other licensed forex dealers or hawala operators for your forex needs.Now not only banks and travel agents have gone online,but there are now online-only licensed forex sites,that deliver the foreign currency you buy to your hands.How cool is that?Following is a list of such sites.

Tomorrow is Akshaya Tritiya,and the gold fever is spreading.A lot of people have seen pricey ads like the one to the left and asked me if its a good deal and whether they should go for it.Here is my answer:

Tomorrow is Akshaya Tritiya,and the gold fever is spreading.A lot of people have seen pricey ads like the one to the left and asked me if its a good deal and whether they should go for it.Here is my answer: