Buying Life Insurance – A Balancing Act

July 25, 2016 Leave a comment

The conventional financial wisdom is that people best serve themselves by purchasing an online term insurance plan and investing the rest of the premium in diversified equity mutual funds. I have a slightly different take on the matter. Let me explain. Many readers have remarked on the difference between my stand and that of other experts.

The conventional financial wisdom is that people best serve themselves by purchasing an online term insurance plan and investing the rest of the premium in diversified equity mutual funds. I have a slightly different take on the matter. Let me explain. Many readers have remarked on the difference between my stand and that of other experts.

If you are young, just started working, have little savings, come from a family with little savings, are the sole or main bread-winner of the family and have many dependents, an inexpensive term insurance plan is your best bet. Even as you work towards building wealth, you don’t put your loved ones at the risk of destitution, should something happen to you.

Also if you are older but have to provide for home and children and perhaps have mortgage and car loans etc. outstanding, you’d do well to increase insurance cover via a term plan for the duration of these loans to ensure that in your absence unpaid loans don’t add to your family’s miseries. Read more of this post

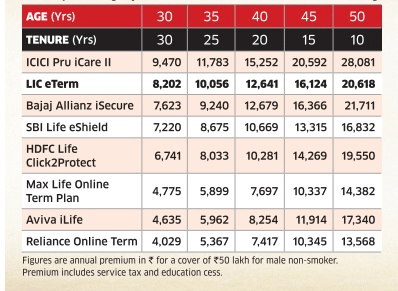

With an ever increasing awareness about term insurance policies, there is a lot for a person to choose and gain from.Insurance companies are making it much easier for people to purchase term policies. One such initiative is online term insurance that allows you to seek life cover from the comfort of home, a fuss free way to buy insurance!

With an ever increasing awareness about term insurance policies, there is a lot for a person to choose and gain from.Insurance companies are making it much easier for people to purchase term policies. One such initiative is online term insurance that allows you to seek life cover from the comfort of home, a fuss free way to buy insurance! If wealth building,wealth protection,estate planning,legacy planning,cash management etc. are not priorities,then an online term plan is probably the best life insurance product you can purchase.

If wealth building,wealth protection,estate planning,legacy planning,cash management etc. are not priorities,then an online term plan is probably the best life insurance product you can purchase.