TCS

August 26, 2014 Leave a comment

Yesterday, TCS, India’s largest software exporter, celebrated 10 years of listing on the stock exchange. It was on August 25, 2004, when TCS made its trading debut on Dalal Street at a 27% premium to its issue price. And, there has been no looking back for the stock, churning a compounded annual return of 27% for a decade.

Yesterday, TCS, India’s largest software exporter, celebrated 10 years of listing on the stock exchange. It was on August 25, 2004, when TCS made its trading debut on Dalal Street at a 27% premium to its issue price. And, there has been no looking back for the stock, churning a compounded annual return of 27% for a decade.

The market capitalisation of the company has risen from Rs47,232 crore to a mammoth Rs4.94 lakh crore in 10 years of listing -the highest among all Indian listed companies.

Investors who stayed put in the stock in the period would have made over three times the average annual compounded returns from fixed deposits. For instance, an investor, who would have put Rs1 lakh in the TCS initial public offer (IPO) at Rs850 a piece, would be sitting on Rs12.52 lakh on Monday . TCS is currently trading at Rs2,521 after two bonus issues -one in July 2006 and other in June 2009. The company has also paid handsome dividends.

In contrast, if the investor had put Rs1 lakh in a fixed deposit with 9% interest in 2004, he would have made Rs2.37 lakh by now without considering taxes. Read more of this post

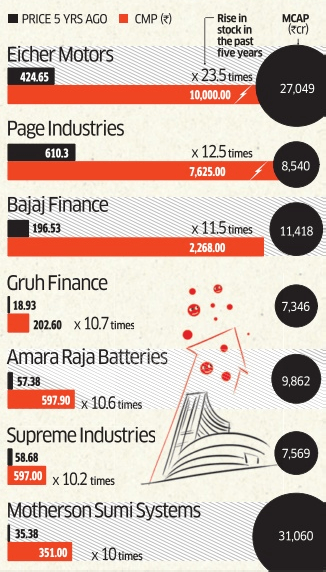

These days,equity investors are laughing their way to the bank because Sensex has generated 44% returns during the past one year. While the benchmark index has generated this return, there are several stocks that have risen by more than 100% during the same period.So, it’s natural for investors to get carried away when Dalal Street is on a roll, and the Sensex is making a habit of hitting record highs almost every other day. Suddenly, retail investors are flocking back to the market if inflows into equity schemes and the number of demat accounts opened recently are any indication.But here lies the catch: retail investors who are entering the ring now may not get the kind of returns from equities as seen in the recent past.

These days,equity investors are laughing their way to the bank because Sensex has generated 44% returns during the past one year. While the benchmark index has generated this return, there are several stocks that have risen by more than 100% during the same period.So, it’s natural for investors to get carried away when Dalal Street is on a roll, and the Sensex is making a habit of hitting record highs almost every other day. Suddenly, retail investors are flocking back to the market if inflows into equity schemes and the number of demat accounts opened recently are any indication.But here lies the catch: retail investors who are entering the ring now may not get the kind of returns from equities as seen in the recent past. The Reserve Bank of India (RBI) has decided to encourage banks and individuals to be actively involved in home loan deposits, a savings product that will help showcase the repaying ability of customers seeking to borrow money to buy a house.

The Reserve Bank of India (RBI) has decided to encourage banks and individuals to be actively involved in home loan deposits, a savings product that will help showcase the repaying ability of customers seeking to borrow money to buy a house.

The Superinvestors of Graham-and-Doddsville is a seminal essay by Warren Buffett.

The Superinvestors of Graham-and-Doddsville is a seminal essay by Warren Buffett.